Transforming internal audit and risk management for Financial Integrity

Internal audit and risk management must evolve beyond compliance. By leveraging Datricks as an AI-powered Financial Integrity platform, organizations can detect exposures, optimize processes, and enhance governance. Learn how technology-driven audit intelligence transforms internal audit into a proactive, value-generating function.

Quick navigation

FAQs

Internal audit and risk management have long been crucial pillars of financial oversight, ensuring compliance, verifying controls, and mitigating exposures.

However, as businesses evolve, so must the role of internal audit. Rather than simply confirming adherence to controls, modern internal audit teams must actively identify, address, and prevent financial exposures – ranging from human errors and non-compliance, to fraud.

By leveraging cutting-edge technology and data-driven intelligence, businesses can enhance financial integrity and maximize value from their audit functions.

Reframing internal audit beyond compliance

Traditionally, internal audit has been centered on verification: confirming records, validating processes, and ensuring controls function as intended. However, this approach is reactive and often limited in scope. While compliance is essential, it does not equate to performance or financial integrity.

Internal audit teams must shift from a compliance-focused role to a proactive, value-generating function that strengthens risk management and enhances strategic decision-making.

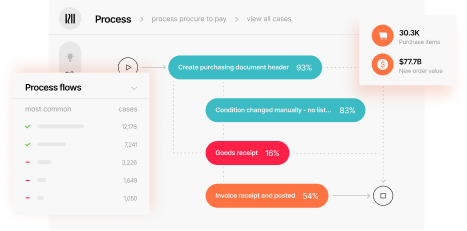

To achieve this, businesses can integrate automated Autonomous Process Discovery, Integrity Exposure Detection, and Integrity Intelligence into their internal audit processes.

This enables organizations and teams to pinpoint financial exposures, reduce operational inefficiencies, and strengthen financial oversight.

Identifying financial exposures proactively

A high-impact internal audit function starts with a deep understanding of financial processes, and thereby, potential exposures.

- Human error

- Non-compliance

- Fraud

Organizations must move beyond periodic audits and implement continuous monitoring to detect:

- Human errors (duplicate payments, misallocated expenses)

- Non-compliance (bypassed protocols, unauthorized transactions)

- Fraudulent activities (supplier collusion, internal misconduct)

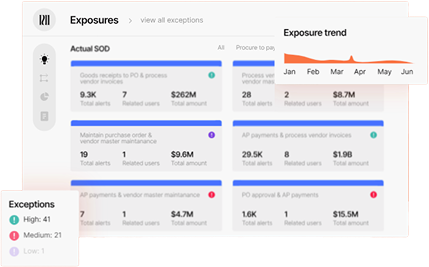

By adopting a continuous Financial Integrity approach, audit leaders gain visibility into financial health, uncovering hidden patterns that traditional audits may miss.

This proactive approach transforms internal audit into a strategic asset rather than a reactive safeguard.

Enhancing communication for stronger governance

Effective internal audit and risk management rely on seamless communication across the organization. Audit teams act as a bridge between finance, compliance, and leadership, ensuring transparency in financial decision-making. However, outdated communication practices can hinder efficiency, causing delays in exposure detection and remediation.

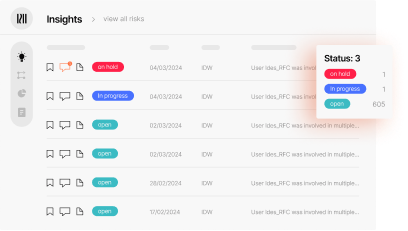

To address this, organizations should implement an AI-driven financial integrity platform that streamline reporting, provide real-time dashboards, and offer intelligent insights.

Equipping internal auditors with clear, data-backed narratives means that businesses can drive increased collaboration, enhance governance, and ensure strategic alignment across all levels.

Leveraging technology for strategic impact

Internal audit teams face mounting pressure to deliver actionable insights while managing increasing complexity. The key to overcoming these challenges lies in technology-driven audit intelligence.

A financial integrity platform empowers audit teams with:

- Autonomous process discovery to continuously analyze financial transactions and workflows

- AI-powered integrity exposure detection for real-time anomaly identification

- Comprehensive integrity intelligence to provide CFOs and finance leaders with a 360° control tower over financial risks

With intelligent automation and analytics, internal audit functions can move from manual oversight to self-driving adaptive controls; optimizing financial processes with minimal effort and maximum accuracy.

Conclusion: driving financial integrity through internal audit innovation

The role of internal audit in risk management must evolve beyond traditional verification. Organizations that embrace automated integrity detection, continuous exposure monitoring, and AI-powered financial intelligence will transform their audit functions into strategic enablers of financial integrity.

Internal audit teams can leverage technology-driven insights, internal audit teams can eliminate financial exposures, reduce compliance gaps, and ensure organizations operate with greater trust, transparency, and financial resilience.