AI and auditing: how technology is amplifying auditing excellence

AI is reshaping auditing with real-time exposure detection, continuous monitoring, and improved compliance. Learn how regulatory and technological advancements have combined to enable finance leaders to ensure financial integrity, including the highest levels of compliance, accuracy and trust in financial operations.

Quick navigation

FAQs

The speed at which business is being conducted today makes it difficult for traditional auditing approaches to remain relevant. There’s a reason AI and auditing are increasingly being mentioned in the same sentence: technology has emerged as the only way to effectively provide the assurance necessary to give an opinion on financial statements, which in turn underpins the global economic system. Manual processes, periodic reviews, and random sampling are no longer sufficient to ensure financial integrity in real time.

Two recent events in the world of AI and audit have further focused attention on what both internal and external audit teams should be prioritizing in 2025 and beyond.

AI as both a risk and an opportunity in audits

In a study by Deloitte, executives AI as both the top risk (44.7%) and the top opportunity (35.9%) for internal controls. Despite significant technological advancements, only 36.4% of organizations update their internal controls more than once a year, increasing the risk of exposures due to mistakes, process shortcuts, and fraud.

This paradox reflects the dual nature of AI in auditing. On one hand, AI introduces new risks, ranging from algorithmic biases to data security concerns, that internal controls must address. On the other, it offers unmatched opportunities to strengthen those same controls through real-time data analysis, continuous monitoring, and automated anomaly detection.

The key insights here are that:

- The risk isn’t AI itself. It’s the failure to evolve internal control environments fast enough to manage the risks and opportunities AI presents.

- It’s AI-powered technology that’s emerging as the only way to adequately ensure Financial Integrity

The regulatory standpoint: the PCAOB’s new quality control standards and a shift toward continuous assurance

In 2024, the PCAOB adopted a new quality control (QC) standard designed to drive continuous improvement in audit quality. This represents a significant departure from legacy frameworks, emphasizing a risk-based approach where firms must:

- Identify specific risks to audit quality

- Design QC systems tailored to these risks

- Continuously evaluate and improve these systems

For both external audit firms and internal audit teams, this indicates a critical shift: moving beyond periodic assessments toward continuous monitoring. It aligns closely with the capabilities of AI; such as real-time data analysis, and proactive exposure identification.

The PCAOB’s update highlights a broader trend: regulators are no longer satisfied with audits that look backward. They expect firms to anticipate exposures, adapt quickly, and maintain continuous assurance, not just periodic compliance.

The strategic layer: why AI and auditing are now inseparable

The integration of AI into auditing processes is already well underway. The process of AI-driven auditing, controls monitoring, and the drive for continuous financial integrity delivers significant advantages:

- Full data coverage: Unlike traditional audits that rely on sampling, AI enables the review of 100% of transactions, identifying anomalies that manual reviews might miss.

- Real-time risk detection: Continuous monitoring allows organizations to detect and address issues as they arise, rather than after the fact.

- Efficiency gains: Automation reduces the time and resources required for audits, freeing finance teams to focus on strategic analysis.

- Enhanced compliance: As regulations become more complex, AI ensures organizations can adapt quickly and maintain compliance without overburdening internal teams.

However, simply adopting disparate AI tools is not enough. Organizations must also evolve their audit methodologies, internal controls, and risk management frameworks to fully capitalize on AI’s potential.

Bringing it all together: how Datricks elevates Financial Integrity

Datricks fundamentally transforms how organizations manage financial exposure and maintain integrity.

The Datricks advantage

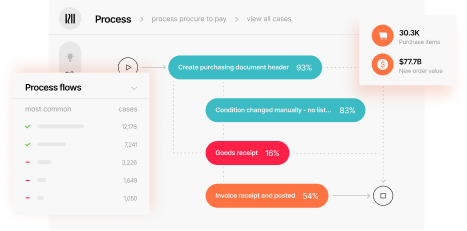

- Autonomous process discovery: Datricks continuously analyzes financial processes without manual input, providing a real-time understanding of business operations and potential exposure areas.

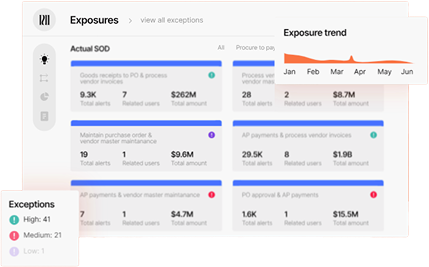

- Integrity exposure detection: Based on its understanding of the process context, the system leverages advanced AI to identify anomalies, fraud risks, and compliance breaches across all business data, not just isolated datasets.

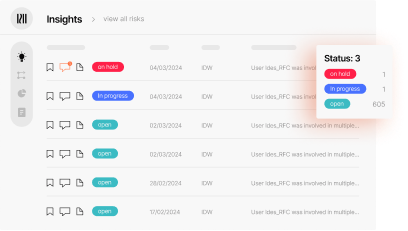

- Integrity intelligence: Finance leaders gain a comprehensive control tower that offers end-to-end visibility into financial health, enabling proactive decision-making and continuous assurance.

Datricks aligns perfectly with the new expectations set by regulatory bodies and the evolving demands of modern finance.

When it comes to AI and auditing, we’re finally in an era where we can reach continuous audit excellence: eliminating financial exposures before they can impact the organization, and ensuring that businesses operate as beacons of financial integrity in an increasingly complex world.