The importance of internal audit management: enabling the third line to deliver assurance

Internal audit management is evolving with AI-driven tools that enhance compliance, detect financial exposures, and streamline audits. Learn how Datricks enables real-time oversight, automated compliance tracking, and the achievement of Financial Integrity.

Quick navigation

FAQs

Organizations today operate within an incredibly dynamic business environment, making internal audit management increasingly critical. The volume of changing regulations, potential exposures, procedures, technologies, and a revolving door of employees make managing and mitigating exposure through the implementation and monitoring of internal controls a crucial concern for leadership teams, and technology has a major role to play.

Internal audit management: a leadership priority

Leadership teams rely on internal audits for assurance and feedback on the integrity of their operations, processes, and transactions to ensure that controls are implemented and operationally effective. Audits play a critical role in providing assurance that risk is managed, compliance requirements are met, and exposures are eliminated.

Clearly understanding the role internal audits play in delivering continuous assurance and not just point-in-time assurance, ensures the financial integrity of the organization.

Three lines model

and risk ownership

An important first step is to define the three lines model (what was formerly referred to as the “three lines of defense”):

The first line: operational management and risk ownership

Operational management owns and manages financial integrity by ensuring that processes align with policies and controls. This first line comprises individuals and teams responsible for executing controls and ensuring their effectiveness. They conduct processes, generate reports, and are on the front lines of identifying and correcting financial exposures before they escalate. By embedding Financial Integrity within operations, this line ensures that exposures such as human errors, non-compliance, and fraud are mitigated at the source.

The second line: risk management and compliance oversight

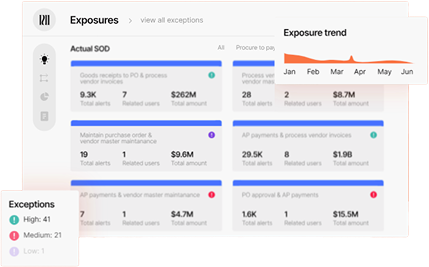

The second line consists of risk management and compliance functions that oversee and monitor financial exposures. These leaders and managers assess the integrity of existing controls, identify vulnerabilities, and implement corrective measures. Their role is to refine and enforce a framework that continuously strengthens financial processes, proactively preventing financial leakage, duplicate payments, and process gaps. Through automated exposure detection and compliance tracking, this line enhances financial resilience and ensures adherence to regulatory standards.

The third line: internal audit and assurance

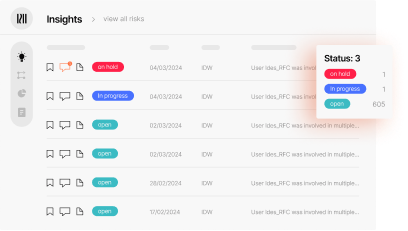

The third line provides independent assurance on governance, risk management, and internal controls. Internal auditors validate the effectiveness of financial processes, ensuring financial integrity across all business units. They serve as strategic advisors to leadership, offering insights based on real-time financial data and exposure detection. By leveraging AI-powered internal audit tools like Datricks, auditors move beyond traditional, point-in-time audits to a dynamic, continuous assurance model.

How internal audit management can elevate the third line with continuous assurance

Historically, internal audit has relied on periodic assessments, making it challenging to detect evolving financial exposures in real time.

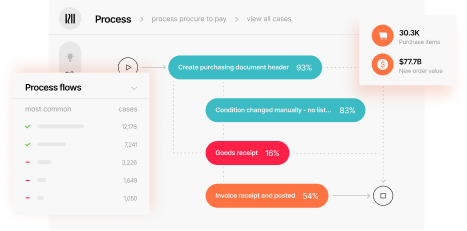

Today, Datricks as an AI-driven Financial Integrity Platform transforms the third line by enabling continuous monitoring, standardizing controls, and enhancing audit efficiency. Key benefits include:

- Real-time exposure detection: AI-powered tools understand processes and analyze transactions continuously, pinpointing financial exposures before they escalate.

- Automated compliance tracking: Self-driving and continuously adapting controls ensure that regulatory and policy requirements are met without manual intervention, while keeping constant track of SoD breaches and other compliance issues.

- Focused auditor efforts: Auditors can focus on examining issues identified as problematic.

By adopting continuous assurance technologies like Datricks, internal audit moves from a reactive function into a proactive driver of financial integrity.

With Datricks, the third line delivers unparalleled oversight, equipping finance leaders with the confidence and intelligence needed to maintain airtight financial integrity.