Surfacing exposures in the mining industry with financial audit software

The mining industry faces significant Financial Integrity challenges, with fraud, human error, and weak internal controls leading to major losses. Traditional financial audit software and analytics tools fall short, but Datricks is transforming how mining companies detect and prevent fraud and other exposures. Learn how mining companies are leveraging this solution to eliminate vulnerabilities and streamline operations.

Quick navigation

FAQs

The mining industry is a key driver of the international economy with ostensibly much oversight and robust controls, yet advanced financial audit software has discovered significant fraud losses across mining companies globally.

We’ll investigate the source of these losses, and demonstrate how a modern Financial Integrity platform can eliminate instances of fraud while ensuring ongoing compliance and trust in their financial operations.

The state of integrity exposure in the mining industry

The following statistics starkly illustrate the current situation.

Fraud in the mining industry

- Per an ACFE report, companies in the mining industry faces a median loss of $912,500

- Common fraud types in mining include asset misappropriation (49%), corruption (23%), and fraudulent billing (13%)

- An EY study found that 71% of mining companies have material weaknesses in internal controls

- Key weaknesses include revenue recognition (35%), financial reporting (29%), and inventory management (22%)

Equally concerning is that these statistics point to a breakdown in internal controls, and a lack of visibility into financial processes.

How advanced financial audit software can address these exposures

Traditional financial audit software is built to make conducting an audit more efficient. It is not aimed at identifying the causes of fraud and other internal weaknesses, and providing the tools to mitigate these.

A modern AI-powered platform would be able to achieve this for mining companies. For example:

Detecting asset misappropriation

Asset misappropriation, accounting for nearly half of all mining industry fraud cases, often involves the theft or misuse of valuable resources. AI-driven anomaly detection platforms can monitor financial processes and transactions, identifying irregularities that may indicate asset misappropriation. By flagging suspicious activities in real-time, AI empowers auditors to respond quickly to prevent losses.

Combating corruption

Corruption remains a significant concern in the mining sector, with 23% of reported fraud cases linked to corrupt practices according to an ACFE report. AI-powered data analytics can scrutinize procurement processes, vendor relationships, and employee interactions to identify potential red flags. Machine learning algorithms can recognize unusual payment patterns, unexplained supplier preferences, and early payments, helping auditors uncover and address corruption risks proactively.

Preventing fraudulent billing

Fraudulent billing, accounting for 13% of mining industry fraud incidents as noted by the ACFE, often involves fictitious invoicing or overcharging schemes. AI-driven invoice root-cause analysis to the granular level of the PO can automatically cross-reference invoice details against historical data and market benchmarks. Suspicious invoices can be flagged for closer examination, reducing the likelihood of fraudulent billing going unnoticed.

Strengthening internal controls

The EY study underscores the prevalence of material weaknesses in mining companies, particularly in areas like revenue recognition, financial reporting, and inventory management. AI-based risk mining tools can continuously evaluate internal controls by analyzing 100% of transactions and historical performance metrics. This enables auditors to pinpoint weaknesses, prioritize remediation efforts, and enhance overall control effectiveness.

Defining the problem: a breakdown in financial integrity

What advanced financial audit software has shown is that financial integrity is lacking, leading to exposures in three main areas:

- Human error: Mistakes happen, but when internal controls aren’t robust enough to pick these up, significant losses can ensue, and the door is opened to more malicious types of intentional fraud

- Non-compliance and process shortcuts: Weak internal controls allow shortcuts to be taken, which in turn weakens the overall controls environment within a mining organization

- Fraud: This includes corruption, asset misappropriation, and fraudulent billing. According to ACFE data, fraud is responsible for an unacceptable 5% loss in revenue for companies worldwide

Addressing these challenges in the mining industry with advanced financial audit software

While many mining companies have implemented financial analytics tools or some form of financial audit software, these solutions don’t run themselves. They weren’t designed with an inherent understanding of your business, meaning they require ongoing modeling to make sense of financial data.

This manual approach simply can’t keep pace with the speed of modern finance, inevitably exposing mining companies to greater risk.

Auditors are working hard, but even with their best efforts, they can only review a limited sample of data. Given the scale and complexity of financial operations, achieving full visibility remains an uphill battle.

Many professionals in the industry are doing everything possible to safeguard their companies’ finances, but the reality is that existing solutions aren’t equipped to meet the demands of today’s financial landscape.

What the industry urgently needs is true Financial Integrity.

Introducing Datricks: the Financial Integrity platform

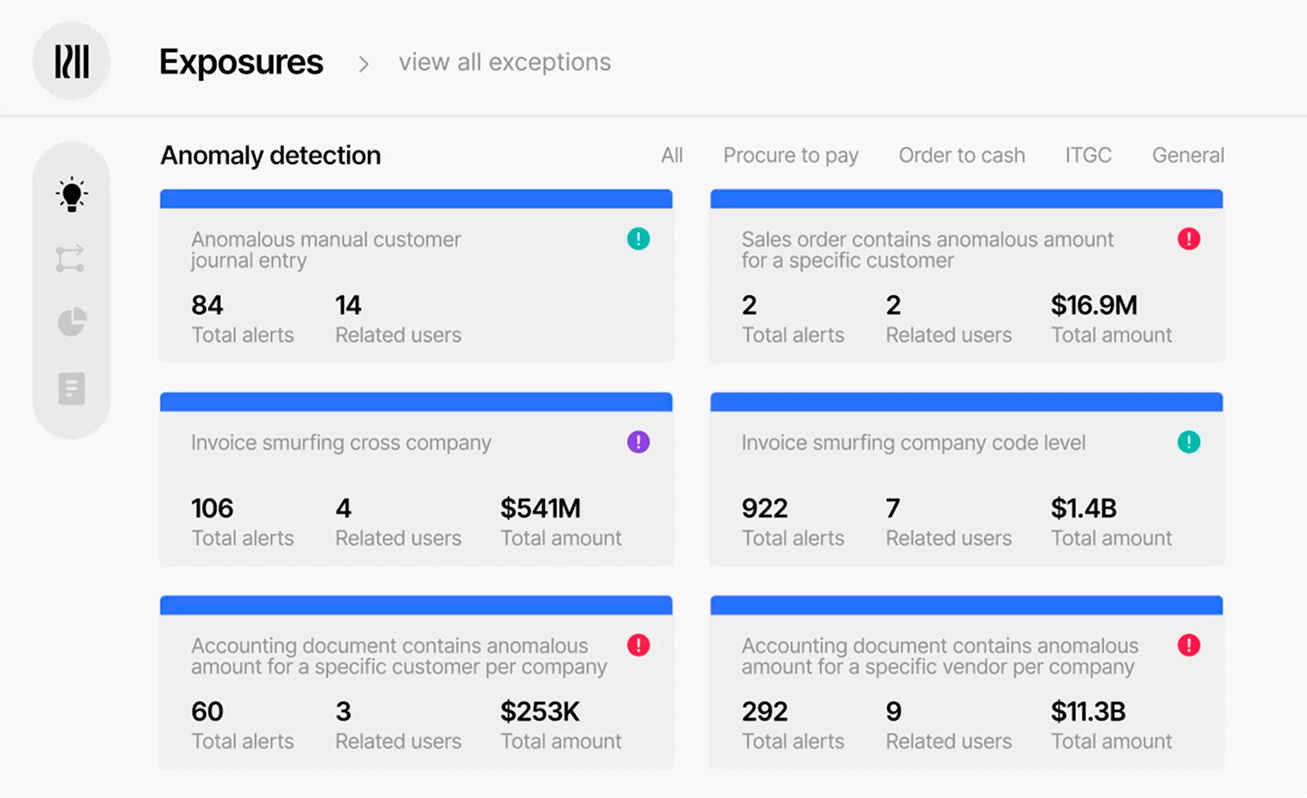

Datricks offers autonomous, real-time control over financial operations, eliminating integrity exposures like human error, non-compliance, and fraud. It achieves this with three distinct elements:

- Autonomous process discovery: Without needing any input from the company or finance team, Datricks automatically and continuously analyzes financial processes to understand the business context

- Integrity exposure detection: Problems are identified across all business data and analyzed by AI in real-time

- Integrity intelligence: CFOs, auditors and other finance professionals get a comprehensive control tower to understand the overall health of their organizations – and the ability to see how they compare to others in the industry.

Setting up Datricks is effortless. Just point the platform at your ERP and other Business Management Solutions, and in less than 7 days, it will autonomously understand the processes and start surfacing exposures – together with actionable insights.