UK SOX and audit reform: ensure compliance

With UK SOX and audit reforms becoming a reality, companies must act fast. Discover how Datricks offers autonomous, real-time control over financial operations, ensuring constant compliance.

Quick navigation

FAQs

With the UK gearing up for stringent SOX and audit reforms, businesses need to act now to ensure compliance. The UK Department for Business, Energy & Industrial Strategy (BEIS) has announced new regulations, closely mirroring the U.S. Sarbanes-Oxley Act (SOX). These changes will likely significantly impact companies listed on the London Stock Exchange, holding top executives accountable for financial reporting and internal controls.

What is SOX and why does it matter for audit compliance?

Understanding the US Sarbanes-Oxley Act (SOX)

Passed in 2002, SOX was designed to increase financial transparency and establish rigorous internal controls. Key requirements include:

- An internal control report confirming responsibility for financial controls.

- Personal accountability of key executives (CEOs and CFOs) for financial accuracy and timely disclosure of operational changes.

- Severe penalties for criminal activities involving financial misrepresentation.

One of the biggest changes that SOX introduced was making executives personally responsible and accountable for organizations’ Financial Integrity.

Key components of UK SOX and audit reform

accountability

competition

engagement

regulation

The UK SOX reform aims to restore trust in corporate governance and audit processes, introducing key recommendations:

- Director accountability: Top executives must personally sign off on financial reports and confirm effective internal controls.

- Audit firm competition: Expanding the pool of external auditors to reduce conflicts of interest.

- Shareholder engagement: Allowing shareholders to review and comment on audit plans.

- Enhanced regulation: Establishing a dedicated UK regulator to oversee compliance and impose disciplinary measures.

Why UK businesses must prepare for SOX and audit reform now

The original SOX deadline was December 2024, and so companies must ensure their internal financial processes are transparent, efficient, and compliant. Failing to meet these standards can lead to material weaknesses, including control deficiencies that increase the risk of financial misstatements. These issues are particularly critical for public companies and can damage investor confidence and company valuation.

Common causes of material weaknesses and exposure

- Human error

- Process shortcuts (for example knowingly or unknowingly bypassing protocols)

- Lack of accounting expertise

- Poorly designed controls and procedures

- Insufficient division of financial reporting responsibilities (SoD)

- Undefined review and approval processes

- Gaps between documented processes and real-world execution

Addressing these weaknesses is essential to maintain compliance and avoid regulatory penalties.

How Datricks supports SOX and audit compliance

Traditionally, preparing for SOX and audit compliance involves manual processes that strain finance and IT teams, including:

- Mapping material business processes affecting financial statements

- Documenting and assessing control effectiveness

- Identifying and correcting process deficiencies

- Conducting tests to verify control performance

Automating compliance with Datricks

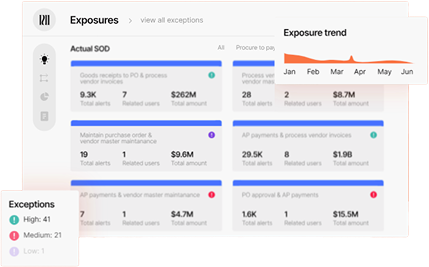

Datricks automates the entire compliance process, reducing pressure on internal teams and external auditors. The platform connects all financial systems into one central hub, extracts and analyzes data at scale, and delivers insights and alerts within days.

Key benefits include:

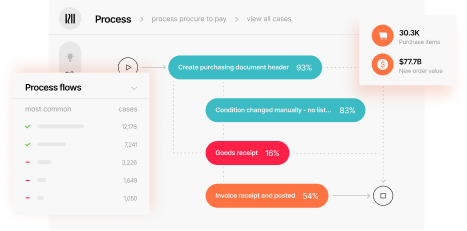

- Automated process mapping: Accurate identification of material processes impacting SOX reporting

- Immediate detection: Over 600 pre-built detections aligned with compliance best practices

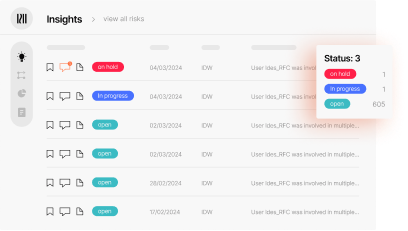

- Real-time visibility: Instant alerts for anomalies, suspicious activities, and process deviations

With Datricks, CFOs, internal auditors, and compliance teams can ensure Financial Integrity, recover lost funds, and maintain audit readiness with minimal effort.