Internal Audit Solutions and Trends for 2025

Explore the latest trends in internal audit and internal audit solutions. See the Top 5 trends, best practices, implementation steps, and how to ensure your internal audit solution is driving business value.

Quick navigation

FAQs

As businesses expand, maintaining Financial Integrity becomes increasingly complex. Internal audit solutions are essential in ensuring transparency, compliance, and efficiency, but traditional audit processes often struggle to keep up with evolving risks.

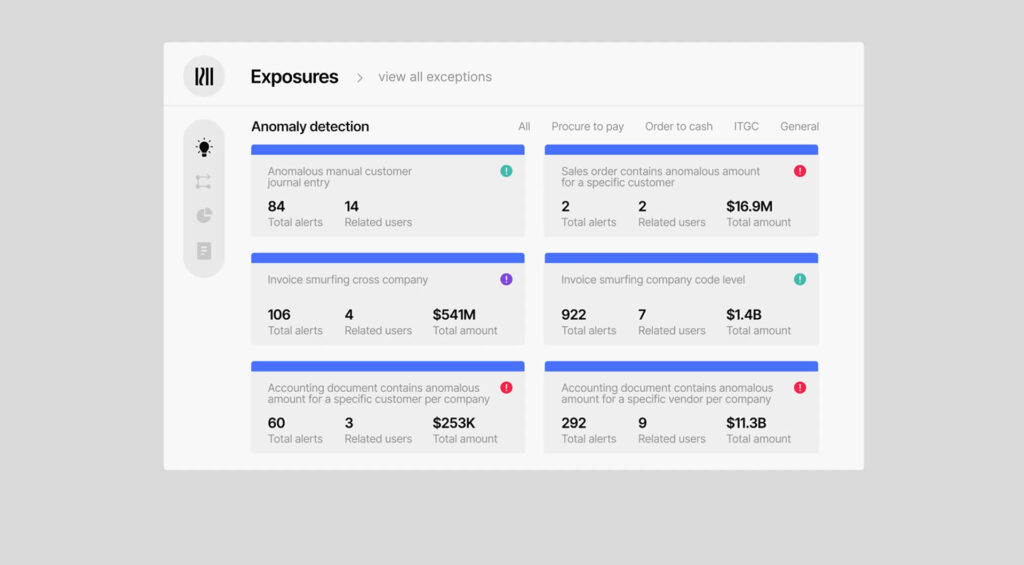

Today’s internal audit teams must leverage advanced solutions to detect financial exposures caused by human errors, non-compliance, and fraud. Modern internal audit solutions focus on automation, intelligence-driven insights, and real-time anomaly detection to safeguard organizations from financial vulnerabilities.

Emerging internal audit trends in 2025

Trend #1: Autonomous auditing and AI-driven insights

With AI and automation taking center stage, internal audits are shifting from periodic reviews to continuous, real-time monitoring. Autonomous audit solutions, like those provided by Datricks, leverage AI-powered process discovery and financial exposure detection to analyze 100% of financial transactions – eliminating manual sampling errors. Machine learning enables anomaly detection and predictive analytics, allowing businesses to proactively address integrity gaps before they escalate into major compliance or financial threats.

Trend #2: Remote and hybrid auditing

The shift toward remote and hybrid work has made virtual audits a necessity. Cloud-based financial integrity platforms allow auditors to perform end-to-end reviews without being physically present. Secure data-sharing technologies, automated workflows, and AI-driven insights enable organizations to maintain Financial Integrity while reducing audit costs and time. This model ensures audit teams can operate efficiently, regardless of location.

Trend #3: Proactive fraud detection and compliance assurance

Internal fraud, non-compliance, and policy breaches remain top concerns for finance leaders. The latest internal audit solutions integrate AI-powered fraud detection tools that analyze financial behaviors in real-time. With 600+ pre-built detections and compliance tracking, platforms like Datricks provide instant alerts on irregular financial activities, helping businesses eliminate fraud risks and maintain airtight compliance without additional manual effort.

Trend #4: Financial integrity as a core business priority

Organizations are recognizing that Financial Integrity is a competitive advantage. Internal audit solutions now serve as control towers for finance leaders, offering real-time visibility into financial health and process vulnerabilities. Companies that prioritize Financial Integrity recover lost funds, optimize working capital, and streamline operations while building trust with stakeholders and regulators.

Trend #5: Faster implementation and flexible deployment

Modern internal audit solutions no longer require complex, months-long implementations. Businesses demand quick setup and flexible deployment options to seamlessly integrate with their ERP and financial systems. Self-driving adaptive controls ensure that internal audit tools evolve with changing business needs, reducing reliance on IT teams and simplifying financial oversight.

Future-proofing internal audits with Datricks

The internal audit landscape is undergoing a radical transformation. To stay ahead, organizations need solutions that automate Financial Integrity processes, detect integrity exposures in real time, and offer intelligence-driven insights. Datricks empowers CFOs, finance leaders and audit teams with the tools they need to eliminate financial exposures, recover lost funds, and maintain peak operational performance – all with minimal effort and maximum impact.

By embracing these internal audit trends and leveraging modern internal audit solutions, businesses can ensure long-term financial stability, mitigate compliance risks, and uphold a reputation of trust and integrity.