Leverage risk management enterprise software to uncover exposure

Today’s CFO has more ground to cover than ever before. With exposures threatening from almost all processes, Datricks’ risk management enterprise software is critical to eliminate exposure and ensure Financial Integrity.

Quick navigation

FAQs

The CFO’s burden: ensuring Financial Integrity

CFOs carry significant responsibility, as they are personally accountable for Financial Integrity within their organizations. Any financial exposure – whether due to human error, non-compliance, or fraud – can have severe consequences, impacting the organization’s credibility, investment potential, and regulatory standing.

A recent KPMG survey highlights that Internal Control over Financial Reporting (ICFR) is the top concern for financial executives. Many CFOs worry that their financial reports lack the necessary mechanisms to ensure accuracy and reliability, putting their organizations – and their careers – at risk.

Drawbacks of raditional audit approaches

processes

fraud detection

financial data

Challenges in detecting financial exposures

Traditional audits serve to enhance the credibility of financial statements, but they are not designed to proactively detect fraud or financial inefficiencies. Alarmingly, the Association of Certified Fraud Examiners (ACFE) reports that 40% of known fraud cases are uncovered by whistleblower tips, whereas only 15% are identified through internal audits. This gap shows the need for a fundamental shift in how organizations approach financial risk and exposure management.

Traditional audit approaches have the following drawbacks:

- Manual processes lead to inefficiencies and oversight

- Reactive fraud detection methods result in delayed responses

- Siloed financial data prevents comprehensive visibility into risks

The future of risk management: automated Financial Integrity solutions

As digital transformation reshapes industries, financial departments must adopt advanced technologies to ensure ongoing Financial Integrity. Automated risk management enterprise software is emerging as the solution; leveraging AI-driven analytics and process discovery to pinpoint financial exposures in real time.

How Datricks elevates financial risk management

Datricks is at the forefront of ensuring Financial Integrity, providing finance teams with an autonomous solution that eliminates financial exposures, including across SAP-driven enterprises.

Elevated financial risk management

Through a deep understanding of financial processes, Datricks enables finance leaders to:

- Gain real-time, data-driven insights into financial processes, ensuring full transparency and trust.

- Automate exposure detection, reducing reliance manual audits and oversight.

- Leverage deep process intelligence to identify inefficiencies, compliance violations, and financial discrepancies.

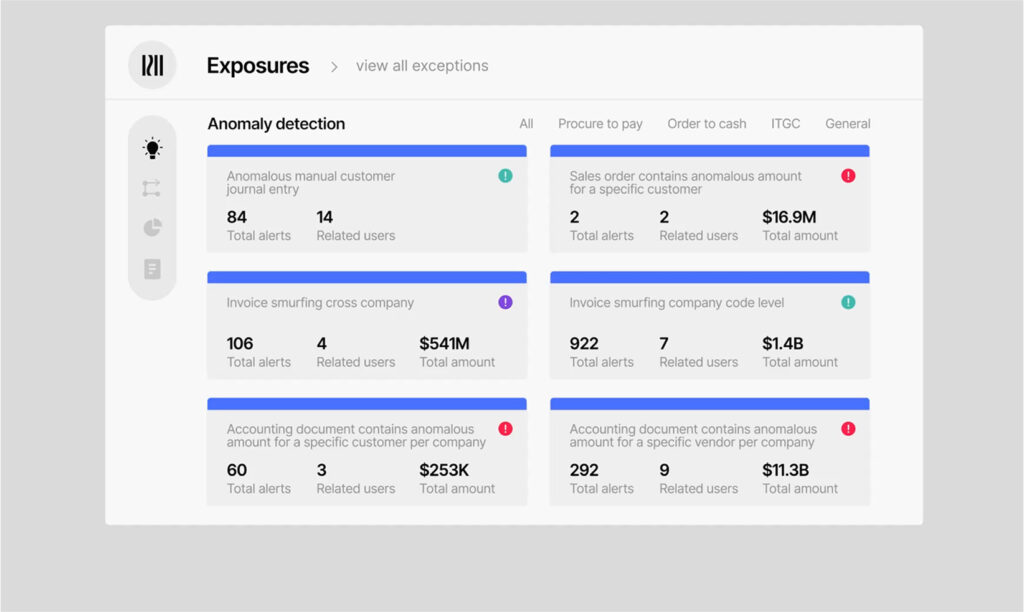

- Enhance process efficiency through AI-powered anomaly detection and real-time alerts.

Key Financial Integrity challenges solved by Datricks

1. Segregation of Duties (SoD) compliance

Ensuring proper SoD is essential in preventing fraud or error. Datricks automates role and access reviews, flagging real-time violations and ensuring compliance with SoD requirements.

2. Duplicate invoice detection

Poor master data management can lead to duplicate payments, costing organizations millions. Datricks continuously monitors invoices, issuing alerts for suspected duplicates and preventing financial loss.

3. Continuous audit and exposure mitigation

Internal audits often miss key financial vulnerabilities. Datricks enables ongoing, automated auditing, including within SAP systems, instantly detecting anomalies and unauthorized activities to prevent compliance violations.

Why finance leaders need risk management enterprise software now

With CFOs increasingly focused on compliance, financial accuracy, and fraud prevention – essentially, ensuring Financial Integrity – adopting an automated, AI-driven risk management enterprise software like Datricks is crucial.

By proactively eliminating financial exposures, organizations can:

- Recover lost funds and prevent future losses

- Streamline financial operations and enhance efficiency

- Ensure continuous compliance with regulatory standards

- Make informed, data-driven decisions with real-time insights

Conclusion: a smarter approach to Financial Integrity

Traditional audits, both internal and external, are no longer enough to safeguard enterprises against financial exposure.

Advanced AI-driven risk management enterprise software like Datricks empowers finance leaders with autonomous, real-time control over financial operations, eliminating integrity exposures like human error, non-compliance, and fraud.

FAQs

- Automated exposure detection to uncover financial risks instantly

- Real-time process intelligence for full visibility into transactions

- AI-powered anomaly detection to prevent fraud and errors

- Seamless ERP integration (e.g. with SAP) for comprehensive financial oversight