Addressing exposure: how internal controls software ensures Financial Integrity

Financial Integrity requires more than manual oversight. AI-powered internal controls software eliminates financial exposures including human error, process shortcuts, and fraud. Discover how Datricks automates financial oversight, enabling CFOs to safeguard operations, recover lost funds, and optimize audit efficiency with minimal effort.

Quick navigation

FAQs

Key takeaways:

- Managing financial exposures requires continuous attention, especially in today’s volatile economic environment.

- Proactive risk management ensures organizations can identify and eliminate financial vulnerabilities.

- Automated internal controls software addresses human errors, ensures compliance, and provides real-time monitoring for financial integrity.

The urgency of stronger internal controls

Economic uncertainty, geopolitical instability, and regulatory changes have intensified financial exposures, making traditional risk management approaches insufficient.

From inflation and global supply chain disruptions to evolving compliance mandates like those from the SEC, businesses face growing challenges in maintaining financial oversight.

Without internal controls software, organizations risk fraud, non-compliance, and financial mismanagement, as manual processes struggle to keep pace with increasing complexity.

According to Gartner, 47% of internal auditors report difficulty adapting to an expanding risk landscape with limited resources. The need for an automated, intelligent financial integrity solution has never been greater.

Internal controls software for continuous assurance

To achieve financial resilience, organizations must shift to continuous monitoring and automated assurance. Manual oversight is no longer viable in environments where:

- Human errors (duplicate payments, overlooked transactions) can lead to costly financial exposure.

- Process shortcuts create compliance gaps and increase the risk of fraud.

- Lack of real-time insights results in delayed detection of financial anomalies.

AI-driven internal controls software addresses these challenges by autonomously detecting financial anomalies, ensuring compliance, and providing CFOs and finance leaders with a 360° control tower over financial health.

Understanding processes: the foundation of Financial Integrity

more trust

lost funds

Financial exposures arise when organizations lack full visibility into how their processes actually work. Gaps, inefficiencies, and deviations from expected workflows can drive or lead to human errors, compliance breaches, and fraud. To effectively manage risks, finance teams need to understand:

- How financial processes function in practice: not just on paper, but in real-time across systems.

- Where breakdowns and inefficiencies occur: uncovering process gaps that lead to financial losses.

- How anomalies emerge: detecting patterns that indicate duplicate payments, unauthorized transactions, or manipulation of financial controls.

Traditional audits and periodic reviews often miss these insights because they rely on sampling rather than continuous monitoring. Organizations need a system that autonomously maps financial workflows, detects exposures as they happen, and provides finance leaders with real-time visibility into their operations.

Datricks: the autonomous solution for Financial Integrity

Datricks transforms financial oversight by automating the detection and prevention of financial exposures. Its Financial Integrity Platform consists of three core capabilities:

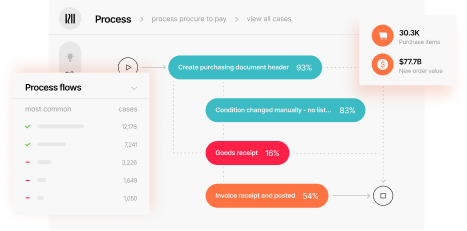

- Autonomous process discovery: Analyzes financial workflows without manual input, continuously mapping processes and identifying inefficiencies.

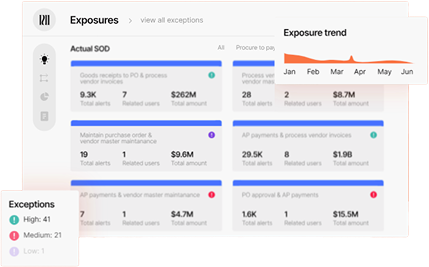

- Integrity exposure detection: Uses AI and machine learning to surface anomalies in real time, pinpointing fraud, human errors, and compliance breaches.

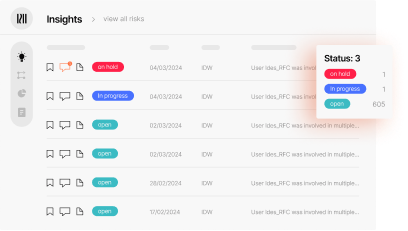

- Integrity intelligence: Provides CFOs, finance leaders, and audit teams with a centralized control tower, offering full transparency and actionable insights into financial processes.

The benefits of intelligent internal controls software

more trust

lost funds

By implementing Datricks’ AI-driven internal controls software, organizations can:

- Build more trust: Review 100% of financial data, continuously surfacing all material exposures.

- Recover lost funds: Prevent financial loss by eliminating duplicate payments, pay terms manipulation, and maverick spending.

- Achieve peak performance: Strengthen compliance, optimize financial workflows, and minimize disruptions.

- Reduce effort, increase results: Automate financial oversight with AI-driven intelligence.

- Pinpoint critical issues: Surface anomalies in real-time, ensuring immediate corrective action.

- Focus auditor efforts effectively: Enhance audit efficiency by directing attention to high-impact areas.

The future of Financial Integrity

2025 and beyond demand a shift from traditional compliance-focused approaches to proactive financial integrity management. Organizations that implement AI-driven internal controls software will eliminate financial exposures, enhance compliance, and safeguard their financial health.

With automated exposure detection and real-time monitoring, finance leaders can build resilient, fraud-proof financial systems – ensuring accuracy, compliance, and trust in their financial operations.