PCAOB Rule 3502 update: bringing personal responsibility to compliance and audits

The PCAOB Rule 3502 update raises the bar for audit accountability, expanding liability to include negligence and not just recklessness. Learn how Datricks empowers auditors with AI-driven tools to detect and eliminate exposures, ensure accuracy and trust, and uphold Financial Integrity.

Quick navigation

FAQs

With its mandate to protect investors and further the public interest when it comes to accurate and trustworthy audit reports, the PCAOB has updated its Rule 3502 to bring it in line with stakeholder requests to increase personal responsibility when it comes to compliance and audits.

Rule 3502, originally known as “Responsibility Not to Knowingly or Recklessly Contribute to Violations,” has undergone a significant shift – where previously “recklessness” was required to be proven, after the amendment even “negligence” is enough to fall foul of the standard of conduct for associated persons’ contributory liability.

This update speaks to the value of Financial Integrity. Audit teams and finance leaders are now having to be extra vigilant that no exposures are going undetected, be they fraud (or recklessness) or even mistakes and human error (often within the realm of negligence).

While some auditors may view this rule as yet another layer of complexity, it’s crucial to recognize that its intent is not to burden those already adhering to established standards. Instead, PCAOB Chair Erica Williams has emphasized that auditors who are diligently performing their duties should not be significantly impacted by this amendment.

Compliance and audits: the foundation of audit responsibilities

The PCAOB and SEC have long emphasized the importance of auditors exercising “reasonable care” when conducting audits. This principle forms the bedrock of responsible auditing practices, ensuring that auditors perform their duties with due diligence, professionalism, and integrity.

The challenge of regulatory amendments

With the introduction of Rule 3502, the regulatory landscape has seen a subtle shift. While the core principles of audit responsibility remain unchanged, this amendment serves as a reminder that auditors can not knowingly or recklessly contribute to violations.

In essence, it reinforces the need for auditors to exercise heightened vigilance when assessing compliance and audits. Are you doing all you can in your assessments, including leveraging available technology to eliminate exposures and ensure Financial Integrity?

Technology as a ghamechanger in compliance and audits

As an auditor, you do your best to ensure financial statements accurately represent the financial position of the company being audited. But you can’t know what you don’t know, and you need to demonstrate that you have done everything in your power to address Rule 3502’s recklessness and negligence elements.

Here’s where technology enters the equation as a powerful ally for auditors facing the challenges of these regulatory amendments:

The risks of Rule 3502 in compliance and audit

- Mistakes

- Process shortcuts

- Fraud

The compliance and audit risks referred to in Rule 3502 are often centered around:

Mistakes

Of course, honest mistakes can happen. For example, multiple records for the same entity may be created under different names, resulting in duplicate payments. However, auditors have to be able to find these mistakes. Depending on scope and materiality, not doing so could be considered negligence.

Process shortcuts

Protocols can be knowingly or unknowingly bypassed. For example, employees may override obligatory process approvals or requirements just to get their jobs done faster. This breakdown in internal controls, if not pinpointed and addressed, could be considered negligence or even recklessness.

Fraud

Not picking up fraud, which was a key driver in the PCAOB update, can certainly be considered recklessness or negligence. Fraud is happening all the time – the headlines prove it – so auditors need to leverage every tool at their disposal to ensure it’s not happening on their watch.

How datricks helps focus audit efforts and reduce exposure

Datricks was built to address the potential exposures we’ve just mentioned. It helps auditors eliminate exposures, and ensure ongoing Financial Integrity.

This is how it addresses these integrity exposures:

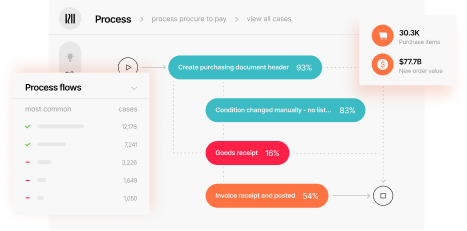

Autonomous process discovery: Without needing any input, Datricks automatically and continuously analyzes the client’s financial processes to understand the business context.

Integrity exposure detection: Problems and anomalies are identified across all business transactions and analyzed by the platform’s AI in the context of the client’s financial processes in real time.

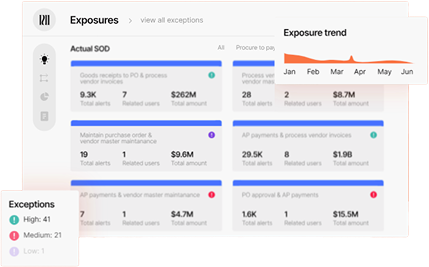

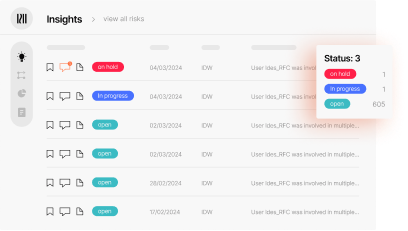

Integrity intelligence: Finance leaders and auditors get a comprehensive control tower to understand the overall financial health of the client organization, including surfacing areas where potential exposure is highest.

Conclusion

The introduction of PCAOB Rule 3502 serves as a reminder that the auditing profession is subject to continuous evolution. Rather than viewing regulatory amendments as impediments, auditors can embrace technology like Datricks as a strategic tool to focus audit efforts.