The future of internal audit software: why virtual-first still wins in an RTO world

Traditional audits are outdated in almost every way. The modern, AI-powered Financial Integrity platform from Datricks enables continuous control, without needing a physical presence in every audit location.

Quick navigation

FAQs

It’s hard to believe how much has changed in the last few years. As organizations navigate the shift back to office spaces (RTO or “Return to Office”), one truth remains clear: virtual processes have proven their value, especially in internal auditing, and with internal audit software specifically.

While some businesses are eager to return to pre-pandemic workflows, others recognize that technology-driven auditing is the future.

The reality check: internal audit in a hybrid world

Internal audit teams face growing pressures: budget cuts, evolving compliance demands, and an ever-expanding exposure landscape. The Institute of Internal Auditors found that:

- A third of internal audit functions have faced budget reductions

- Three-quarters have had to revise their audit plans

- Almost 40% of internal auditors have shifted focus to non-audit work

With these challenges, traditional, manual-heavy internal audit processes are in many cases no longer relevant.

The rapid adoption of internal audit software is accelerating, helping finance leaders move beyond outdated workflows to real-time, AI-driven Financial Integrity solutions.

Elevated financial risk management

vulnerabilities

risks

silos

priorities

Key challenges in the modern business environment

Even with RTO, organizations must address emerging integrity exposures:

- Access vulnerabilities: More users need system access, increasing the risk of bypassing internal controls.

- Fraud risks: Home offices remain unsecured, and internal control processes built for centralized work are ineffective in a hybrid setting.

- Collaboration silos: Audit teams struggle to maintain communication and meet deadlines in a dispersed workforce.

- Shifting priorities: Internal audit teams need to proactively address financial exposures, not just react to compliance demands.

Rising to the challenge with AI-Driven internal audit software

Forward-thinking organizations are leveraging AI and automation to adapt. Key strategies include:

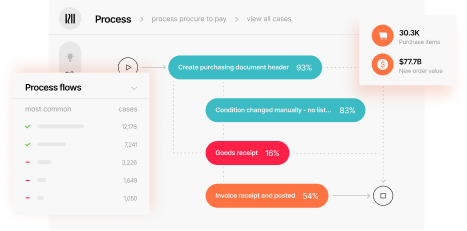

- Autonomous Process Discovery: Identify financial process gaps without manual effort.

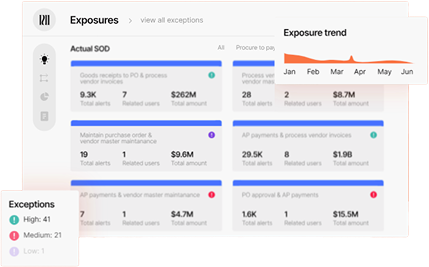

- Integrity Exposure Detection: Pinpoint errors, compliance gaps, and fraud risks in real-time.

- Integrity Intelligence: Gain a centralized control tower for finance, ensuring visibility and accountability across operations.

The future of internal auditing: tech-enabled, always-on, and smarter

Leading organizations are deploying internal audit software to drive efficiency, recover lost funds, and strengthen Financial Integrity. Datricks is the ultimate solution, enabling finance teams to:

- Automate internal audit workflows to reduce manual effort and enhance accuracy.

- Uncover anomalies instantly with AI-powered analysis that detects duplicate payments, maverick spending, and other compliance breaches.

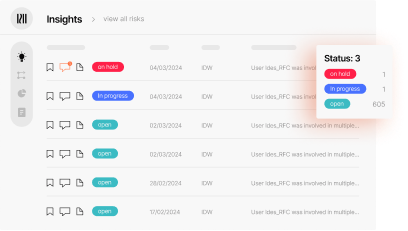

- Pinpoint auditor efforts by prioritizing based on value amount and entity sensitivity, and ensuring auditors dedicate time to the most problematic issues, instead of randomly sampling data.

Final thoughts

The shift to remote and hybrid work has exposed inefficiencies in legacy audit processes, forcing finance leaders to rethink how they approach Financial Integrity.

Whether your team is returning to the office or embracing a hybrid model, AI-driven internal audit software ensures your organization stays ahead of financial exposures, compliance risks, and fraud threats.

Datricks delivers a seamless, automated solution that helps finance leaders pinpoint critical issues, optimize resources, and build trust in their financial data, without the inefficiencies of traditional audit methods.

The future of internal auditing is intelligent, proactive, and built for Financial Integrity.