Hyper automation: end-to-end automation by harnessing the power of AI with process mining

Hyper automation: end-to-end automation by harnessing the power of AI with process mining

Solution description

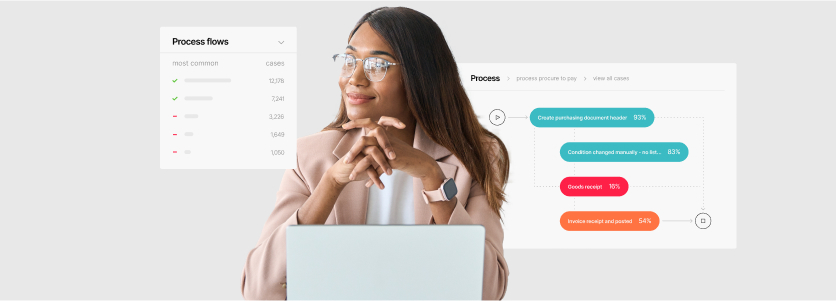

Datricks allows your organization to move from a periodic audit process to a hyper-automated continuous audit which is faster, more accurate, and more efficient. Datricks connects live to SAP systems of record and automatically extracts business data, instantly discovering risks for financial teams to mitigate rapidly and efficiently. By integrating the intelligence of AI with the power of process mining, Datricks dynamically discovers business processes and automates actions to rapidly respond to risks or deviation in compliance controls.

Pain points

Uncovering financial process gaps, finding the root cause for specific issues, and acting upon them rapidly is almost impossible in complex financial environments. This usually involves multi-disciplinary teams of expensive domain experts, analyzing small data samples, and manually “fixing” it.

The Datricks approach is based on hyper automation which uncovers and maps previously hidden data and processes. This offers the benefit of automated alerts and AI which uncovers hidden opportunities and risks. Manual approaches leave these risks and insights hidden and cannot automate their solutions. To deliver this, the entire solution is based on no-code and automation, from end-to-end. The result is a more accurate and more efficient compliance process with continuous controls, and real-time risk and fraud identification.

Business value

- Automate and templatize tasks:

AI process mining driven process that feeds on data, leading to more accurate, faster and more efficient results - Apply continuous compliance:

Achieve a digital first audit environment adaptable to ongoing changes allowing continuous audit and continuous controls - Fast time to value:

Datricks unveils, identifies, evaluates and prioritizes risks in less than 5 days - Self service:

Audit and compliance teams can implement and analyze controls themselves - Identify and analyze risks:

Get full visibility to all your financial activities and tasks across all systems and produce accurate insights and alerts - Mitigate risk:

With continuous controls, risk and fraud are identified as they happen – not months later